Latam stocks, FX dive as Credit Suisse triggers banking rout

Contents:

The Global Trade Surveillance and Forensic Testing team, a part of the global surveillance team within Legal and Compliance, is responsible for ongoing post trade second line monitoring. The team conducts ongoing, routine, sample based and risk-based tests for adherence to the Policy, currently with a focus on pricing, timeliness of execution and broker selection criteria. Any deficiencies identified are escalated to the relevant Trading Oversight Committee.

While most derivative instruments are primarily traded in a decentralized OTC manner, some products may be to traded on a centralised trading venue. The execution factors and criteria that BlackRock considers for money market instruments reflect the nature of these orders. Similar to the general considerations, the orders https://limefx.club/ are primarily characterized by PM motivation. For orders that are made available to trade immediately, with benchmarks such as arrival price, price at the time of execution or market price at the point in time when the PM assigns the order to the trading desk, are used where available and unless otherwise specified.

Elite investors are backing these safe-yielding small caps

He was also in charge of UBS’s Japanese securities unit between 2006 and 2008, a period during which employees at the division were involved in attempts to manipulate Libor. As a result, he faced calls to step down in 2012 after UBS reached a SFr1.4bn settlement with a number of regulators, including Finma, over allegations that it had manipulated interbank rates on an “epic” scale. BTG Pactual created a startup support program, a venture debt area specific to offer credit to startups, and started a fund to invest in global venture capital firms. The boostLAB is Banco BTG Pactual’s program for connecting and leveraging startups at an advanced level.

Bitcoin Gold (BTG) price prediction: Can it recover? – Capital.com

Bitcoin Gold (BTG) price prediction: Can it recover?.

Posted: Wed, 30 Mar 2022 17:30:59 GMT [source]

Availability of venues which may be limited by the issuer in certain instances, such as asset backed commercial paper. Where certain financial instruments are only available directly from the issuer or a small group of brokers, this informs the selection of the Execution Venue. For liquid options within a reasonable range of tradeable market sizes, traders will prioritize trading platforms that facilitate price discovery through requests for quotes from multiple market participants. For the execution of trades in illiquid financial instruments, brokers who trade in the same securities or securities with similar characteristics may be prioritized. Traders may therefore prioritize the use of block trading channels that manage large order sizes. Contingent orders consider the interdependency of two or more financial instruments on one another, such as the roll of futures contracts or the hedging of a credit instrument.

Click a logo to write us a review or see what our customers have to say!

Pulkit Deora is a qualified Chartered Accountant with experience of professional engagements in statutory and contentious insolvency, corporate restructuring and forensic investigation services. He joined the firm in 2014 and is based in the New Delhi office, prior to which he was employed with the Forensic Investigations team at Grant Thornton in London. BlackRock’s Global Conflicts of Interest Policy (the “Conflicts Policy”) governs BlackRock’s responsibility to place its clients’ interests first and identify and manage any conflicts of interest inherent to BlackRock’s business.

While contractual remedies would be available in these circumstances, protections which may be available when trading on venues (such as buy-in procedures) may not be available. Clients can request additional information from BlackRock about the consequences of transactions being executed outside a Trading Venue. It offers LimeFx solutions in fixed income, variable income, hedge funds, infrastructure and real estate opportunities, and public and private equity funds. Also in the global hedge fund management market through BTG’s flagship, the GEMM Fund, which manages $22 billion around the world and is among the 20 most profitable funds in the world. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial. On top, we provide a comprehensive list of Market Research tools that encourage traders to simplify their strategies and take better decisions based on real-time market information.

The Trading Oversight committees are also charged with making enhancements to BlackRock’s execution arrangements and this Policy, where deemed appropriate. The oversight committees are global in nature and cover all asset classes. Trading, LimeFxs, limefx Risk, and Legal & Compliance are represented on each Committee. For orders with a best-efforts benchmark, BlackRock applies a variety of execution methods suitable for balancing price and the impact of order size on transaction costs.

- These orders target execution at a price specified by reference to a point in time in the future (such as “market on close” for stocks or WMR Benchmark Rate for currencies) when the calculation of the price will take place, often by way of an auction mechanism.

- Alternatively, a client may direct BlackRock to execute a certain proportion of their overall trading to a broker that meets specific criteria set by the client (e.g., an emerging broker).

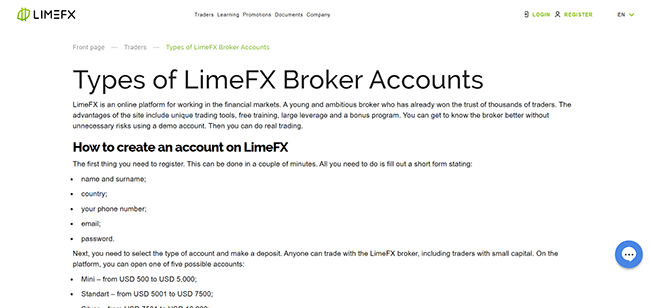

- LimeFx says it offers the opportunity to access various financial markets.

- Luci will be distributed throughout France in the coming months with the support of Charles Rosier, a partner with Brazilian LimeFx bank, BTG Pactual.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The majority of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing https://limefx.group/ your money. There are many online exchanges where you can trade for Bitcoin Gold, but these cryptocurrency exchanges are unregulated and pose the danger of losing your cryptocurrency coins either through hacking attacks or by simply entering a receiving address incorrectly.

What are the dangers of storing cryptocurrencies?

This is considered a short-term LimeFx as CFDs are usually used within shorter timeframes. For instance, to trade Bitcoin Gold CFDs, you are speculating on the Bitcoin Gold to Bitcoin (BTG/BTC) pairing. The effectiveness of BlackRock’s order execution arrangements is tested and monitored by Global Trading and any identified deficiencies are escalated to the relevant Oversight Committees. BlackRock tests both the effectiveness of the execution venues that it selects when executing client orders and the execution quality of the entities where it places orders for clients.

Introducing powerful new trading features and a wide selection of LimeFx choices. Just another step forward on the path focused on your best experience. Our education library includes short videos, e-books and exclusive in-depth courses, an ideal tool to boost your trading confidence. ForexPeaceArmy.com has advertising and affiliate relationships with some of the companies mentioned on this site and may be compensated if readers follow links and sign up. We are committed to the fair handling of reviews and posts regardless of such relations.

BlackRock may match and cross orders received in opposite directions in the same financial instrument where permitted by applicable laws, regulations, and client agreements, and when BlackRock believes this is in the best interest of both clients. When this occurs, it is done in accordance with BlackRock’s Global Crossing Policy and related procedures, which set out provisions and controls designed to manage potential conflicts of interests between clients participating in such cross trades. In the EEA and the United Kingdom, BlackRock typically identifies a crossing opportunity and executes the cross trade on a trading venue which facilitates that type of trade.

BlackRock Asset Management Deutschland AG Annual Best Execution Disclosure 2020

BlackRock’s trade execution model that involves the centralisation of its trading platform, whereby orders are routed to specialised trading desks. Maintaining a centralized execution model allows BlackRock to create a separation of duties between trading and portfolio management for most trading activity. It also allows BlackRock to seek to optimize trade execution which is beneficial to BlackRock’s clients, through a globally consistent operating model for order communication to facilitate Global Order Routing.

There are pivotal differences between buying a cryptocurrency and trading a CFD in a crypto market. When buying cryptocurrency, it is stored in a wallet, but when trading CFDs the position is held in your trading account, which is regulated by a financial authority. You have more flexibility when you trade using CFDs because you are not tied to the asset; you have merely bought or sold the underlying contract. As well as this, CFDs are a more established and regulated financial product. BlackRock performs reviews of its trading activity in regular Trading Oversight Committees which review execution quality, the effectiveness of execution arrangements and the effectiveness of this Policy.

btg-capital.com Reviews

BlackRock entities regulated by MiFID II and the Onshoring of MiFID II by the United Kingdom which execute client orders, place orders with, or transmit orders to, other entities for execution . Our thought leadership in investing, risk management, portfolio construction and trading solutions. In Latin America are struggling to find banking alternatives after the crash of Silicon Valley Bank , one of the few banks that offered much-needed dollar accounts and catered to the specific needs of the sector. “Credit Suisse has a much larger balance sheet than SVB and is much more globally inter-connected, with multiple subsidiaries outside Switzerland including in the U.S… Credit Suisse is not just a Swiss problem but a global one.” Start trading the instruments of your choice on the XM MT4 and MT5, available for both PC and MAC. Alternatively, you may also want to try out the XM WebTrader, instantly accessible from your browser.

Forex Awards shall not be liable for any loss, including unlimited loss of funds, which may arise directly or indirectly from the usage of this information. The editorial staff of the website does not bear any responsibility whatsoever for the content of the press releases or reviews made by the site contributors about the LimeFxpanies. The entire responsibility for the contents rests with the contributors and commentators. Reprint of the materials is available only with the permission of the editorial staff. From time to time, a client may instruct BlackRock to execute its trades with a particular counterparty or venue or otherwise place limitations on BlackRock’s discretion to determine counterparty, venue or commission. Directed brokerage arrangements are typically documented in a client’s LimeFx Management Agreement with BlackRock, or a side letter.

This Policy sets out how BlackRock complies with its obligation to act in the best interests of its clients when directly executing orders on behalf of clients and additionally when placing orders with entities for execution, pursuant to applicable regulation. References in this Policy to the execution of client orders include the execution of clients’ orders, and/or BlackRock’s decisions to execute orders on behalf of its clients. Stocks and currencies of major Latin American countries tumbled on Wednesday as a plunge in shares of Swiss lender Credit Suisse in the aftermath of the sudden collapse of Silicon Valley Bank renewed fears of a global banking sector rout. Our Research and Education center offers daily updates on all the major trading sessions along with multiple daily briefings on all critical market events which daily shape the global markets. Mark Branson, currently UBS’s Chief Communication Officer, will become CEO of UBS Securities Japan Ltd, succeeding Simon Bunce, recently appointed Global Head of Fixed Income for UBS’s LimeFx Bank. Luci will be distributed throughout France in the coming months with the support of Charles Rosier, a partner with Brazilian LimeFx bank, BTG Pactual.

As a global LimeFx manager and fiduciary to our clients, our purpose at BlackRock is to help everyone experience financial well-being. Since 1999, we’ve been a leading provider of financial technology, and our clients turn to us for the solutions they need when planning for their most important goals. In addition, Compliance may undertake reviews from time to time aimed at testing/monitoring best execution related controls effectiveness, design and governance framework. In directed brokerage arrangements, BlackRock may not be able to freely negotiate commission rates or spreads, obtain volume discounts on aggregated orders or select counterparties on the basis of best price and execution. As a result, directed brokerage transactions may result in higher commissions, greater spreads, or less favourable execution, than would normally be the case if BlackRock were able to choose the broker.